In an era when digital landscapes are expanding exponentially, Bitcoin mining and AI have become a focal point of discussion and innovation. As the global demand for digital currencies rises, so does the scrutiny over the environmental impact of their production. Advancements in artificial intelligence promise gains in efficiency and productivity while requiring energy management and conscientious consumption. There is an intricate relationship between these dynamics, bringing both challenges and opportunities.

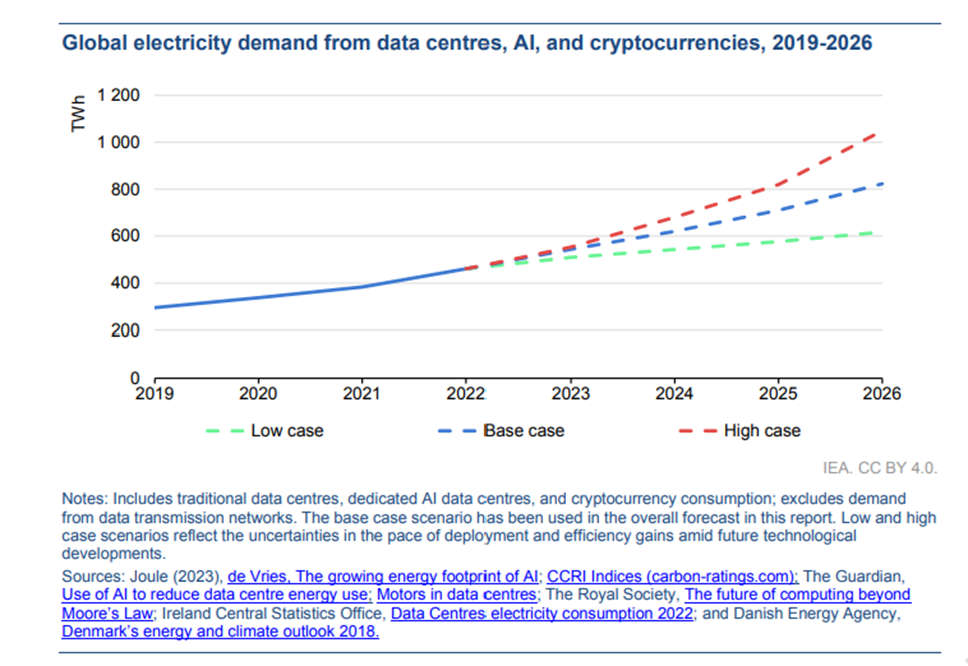

There are, of course, future implications for both technology and sustainability. The International Energy Agency (IEA) released a report projecting a doubling of electricity consumption by data centers by 2026. This is driven primarily by the demands of cryptocurrency mining and AI.

How will this surge in demand impact electricity prices for businesses? Historically, businesses have locked into fixed-rate energy contracts for 1-5 years based on current forward pricing and trends. In the past, these trends could be followed by using NYMEX settlement prices until recently, when there’s been a decoupling effect.

This would explain why NYMEX settlement prices are firmly below $3.00/ MMBtu, and yet electricity rates continue to rise. This is where forward pricing comes into play. Consider this: back in 2020, forward pricing on NYMEX averaged $2.53/MMBtu. Today, looking forward to 2025-2028, the pricing has increased by $1.16/MMBtu to an average of $3.69/MMBtu.

What’s driving this change in forward pricing? Primarily, it’s the fundamental dynamics of supply and demand. The escalating growth of data centers, driven by Bitcoin, NVIDIA, the 5G network, and cloud services, substantially increases the demand for electricity. In addition to this, the expansion of LNG facilities is expected to increase exports and drivers like reliability and sustainability, and we are facing a significant increase in energy demands. With this increased demand comes higher pricing for consumers.

Amidst rising electricity demands driven by Bitcoin mining, AI, and digital currencies, businesses are encountering pricing uncertainties. To navigate this evolving landscape, implementing robust energy management and procurement strategies is imperative. For expert guidance and innovative solutions, reach out to Brilliant Source Energy today and secure a sustainable energy future for your business.